The Project On Student Debt estimates that the average college senior in 2009 graduated with $24,000 in outstanding loans. Last August, student loans surpassed credit cards as the nation’s largest single largest source of debt, edging ever closer to $1 trillion. Yet for all the moralizing about American consumer debt by both parties, no one dares call higher education a bad investment. The nearly axiomatic good of a university degree in American society has allowed a higher education bubble to expand to the point of bursting.

Since 1978, the price of tuition at US colleges has increased over 900 percent, 650 points above inflation. To put that in number in perspective, housing prices, the bubble that nearly burst the US economy, then the global one, increased only fifty points above the Consumer Price Index during those years. But while college applicants’ faith in the value of higher education has only increased, employers’ has declined. According to Richard Rothstein at The Economic Policy Institute, wages for college-educated workers outside of the inflated finance industry have stagnated or diminished. Unemployment has hit recent graduates especially hard, nearly doubling in the post-2007 recession. The result is that the most indebted generation in history is without the dependable jobs it needs to escape debt.

Good article about sugar

"Now most researchers will agree that the link between Western diet or lifestyle and cancer manifests itself through this association with obesity, diabetes and metabolic syndrome — i.e., insulin resistance.

So how does it work? Cancer researchers now consider that the problem with insulin resistance is that it leads us to secrete more insulin, and insulin (as well as a related hormone known as insulin-like growth factor) actually promotes tumor growth.”

last nights party

Dear Sonya

Thank you so much for changing my life. Four years ago you had the idea of shooting Polaroid’s in front of awesome backgrounds for your birthday portait project. The lighting I helped you with didn’t quite work out for the Polaroids but look at what it turned into! - I’m able to eat and pay rent and buy you donuts for your birthday (yes, they are coming) and do what I love full time out of that little idea. There is no way i can thank you enough.

HAPPY BIRTHDAY!

I love you and I can’t wait to be an old uncle to you and blazey’s future babies!

- b

It’s 5pm. Do you know where your bodega store owner is? I don’t.

Sugar is evil, I know. So I compromised by putting one less in my coffee.

We’re having and easter pot luck at my place sunday!

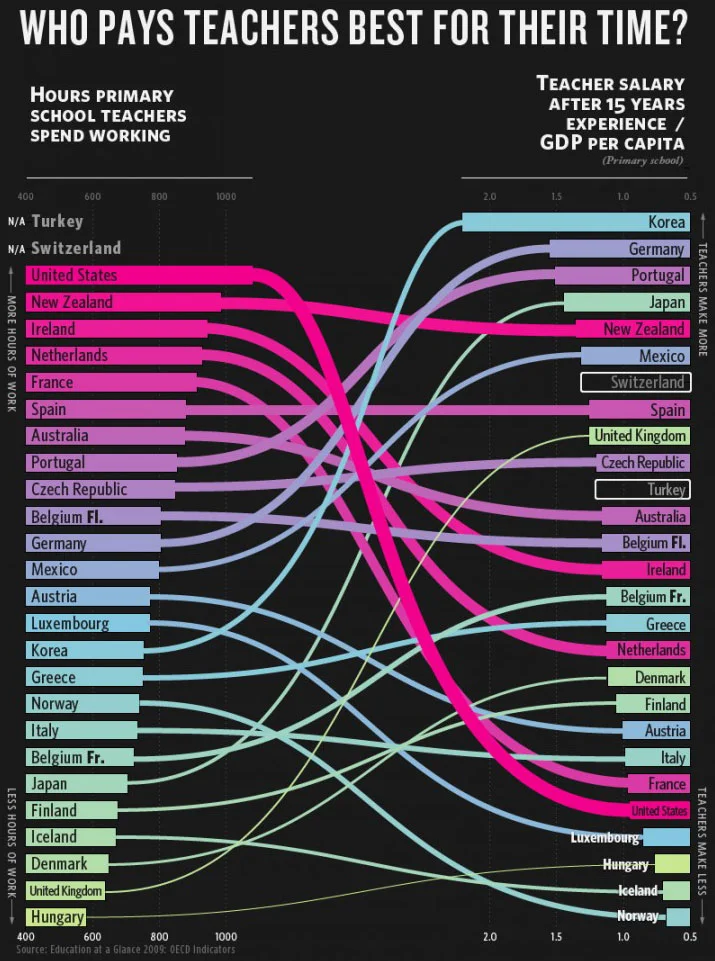

Who Pays Teachers Best for their Time?

Hours primary school teachers spend working on the left.

Teachers salary after 15 years of experience / GDP per capita on the right

The biggie version of this infographic also includes: how much teachers around the world make (Luxembourgh tops), average class size (Mexico tops… or bottoms if you will) and salary levels vs student achievement (Finland tops).

The rare good infographic.

Photos during the drill…

outside

Me and Daddy

Accomplishments on my first cruise with my sister and dad:

1. Convinced Eb that she needed to get a tumblr for all her phone pictures!

2. Ate more buffet food than one ever needs.

Senior Blazey, Senior Browder & Senior King (ps, what beach has wifi!?)

My first time!